salt tax cap removal

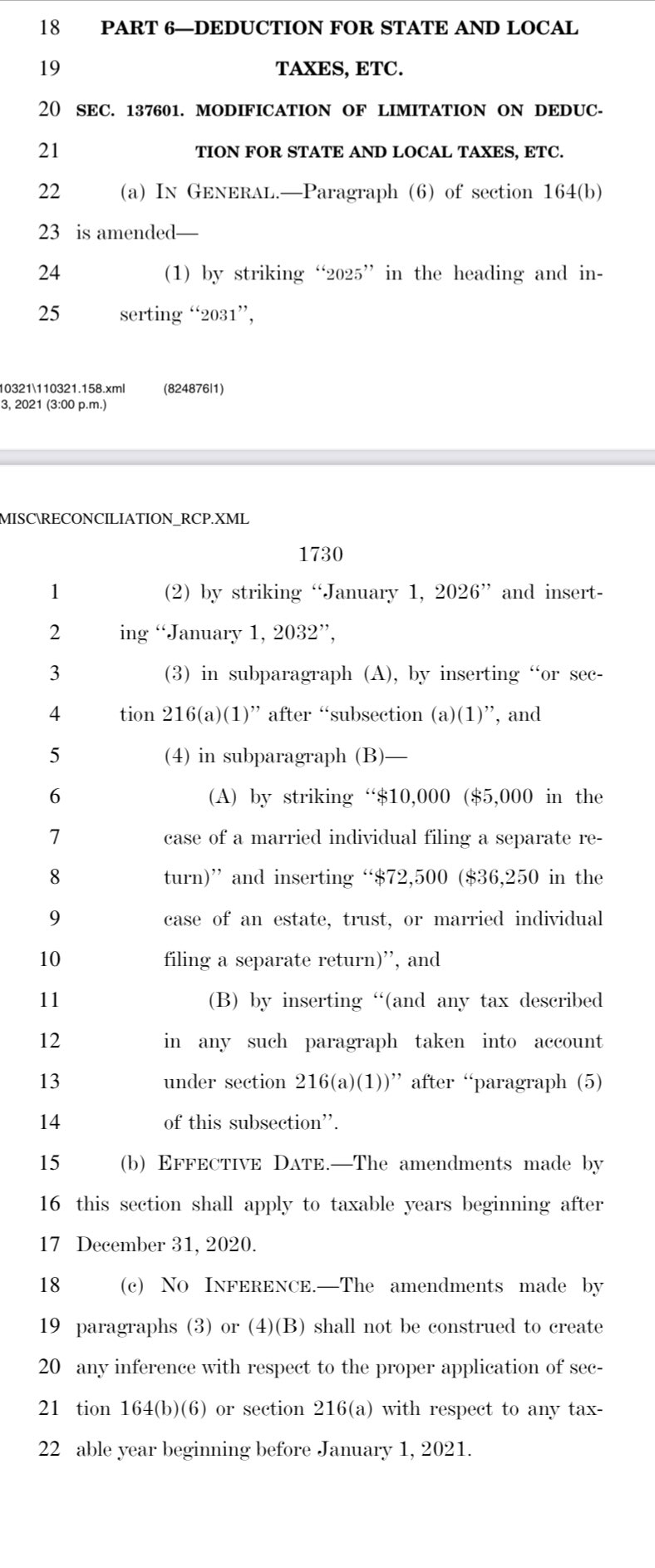

The relaxed cap an increase from the current 10000 limit would last for a decade until 2031. Ad Become a Tax-Aide volunteer.

Salt Tax Deduction Democrats Uncertain Over Ending Federal Cap

If you have an existing mortgage on your residence the tax deferral does.

. Conveniently located in North Park LaserAway is the top provider for aesthetic dermatological services in Dallas Texas. Ad Apply For Tax Forgiveness and get help through the process. Provide free tax prep assistance to those who need it most.

But you must itemize in order to deduct state and local taxes on your federal income tax return. The SALT cap of 10000 is higher than the national average of SALT deductions because of Republican lawmakers in high-tax states who weighed in aggressively during tax. A leader in both non- and minimally.

Ad Discover A Variety Of Information About Tax Relief Companies. A host of moderate Democrats say they wont support President Joe Bidens 35 trillion package without a repeal of the cap on state and local tax deductions known as SALT. The aim is for landowners to realize property tax savings to encourage them to continue to produce vital agricultural products such as livestock cotton timber milk and corn.

You May Qualify to be Forgiven for Tens of Thousands of Dollars in Taxes. LaserAway Dallas North Park. The SALT deal appeared to remove one obstacle to passing the sprawling.

You can make a positive impact in your community and have fun doing it. 52 rows The deduction has a cap of 5000 if your filing status is married filing separately. House Democrats who are pushing to lift a 10000 fixed cap on state and local tax SALT deductions said they will support the Inflation Reduction Act which passed the.

The TCJA also repealed the Pease limitation. We Have A Three-Phase Tax Relief Program That Shows Better Results Than Any Other Firm. Ad OConnor Associates is the largest Property tax consulting firm in Texas.

Second the 2017 law capped the SALT deduction at 10000 5000 if. The Tax Deferral Affidavit form is available on this site or you may contact Customer Service at 214-631-0910. The TCJA paired back the AMT reducing the number of taxpayers subject to it from about 5 million in 2017 to 200000 in 2018.

This cap remains unchanged for your 2021 taxes and it will remain the same in.

Tpc Analyzes Five Ways To Replace The Salt Deduction Cap Tax Policy Center

Igor Bobic On Twitter According To A Summary Of The Budget Resolution The Finance Committee Is Being Instructed To Include Salt Cap Relief In The Reconciliation Bill Twitter

What Proposed Salt Changes Could Mean For Your Next Tax Bill Vox

The Price We Pay For Capping The Salt Deduction Tax Policy Center

Nj House Delegation Calls For Elimination Of Salt Tax Hike

Lawmakers Launch Bipartisan Salt Caucus Escalating Push To Remove Cap On Federal Deductions For U S State And Local Taxes Marketwatch

State And Local Tax Salt Deduction Salt Deduction Taxedu

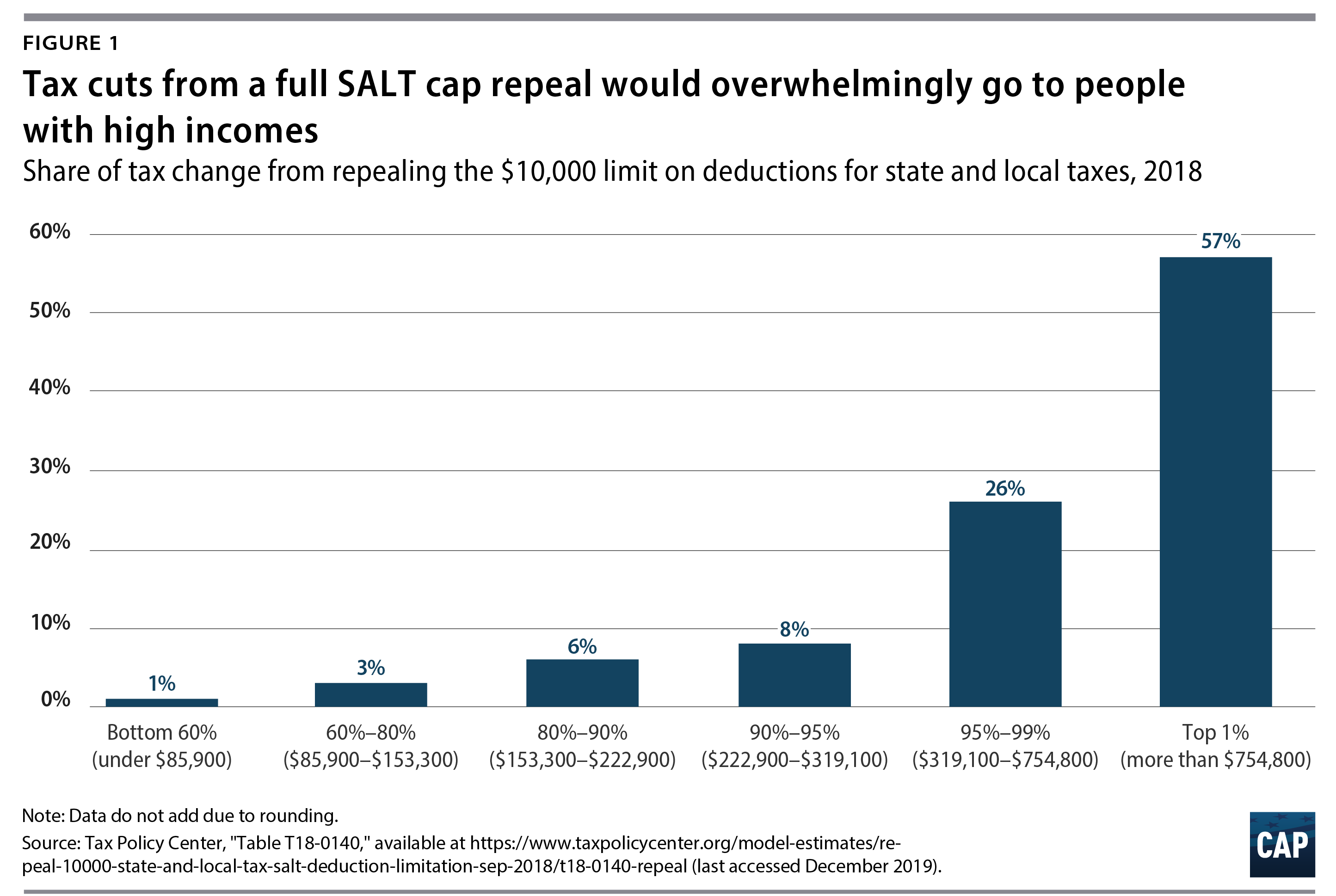

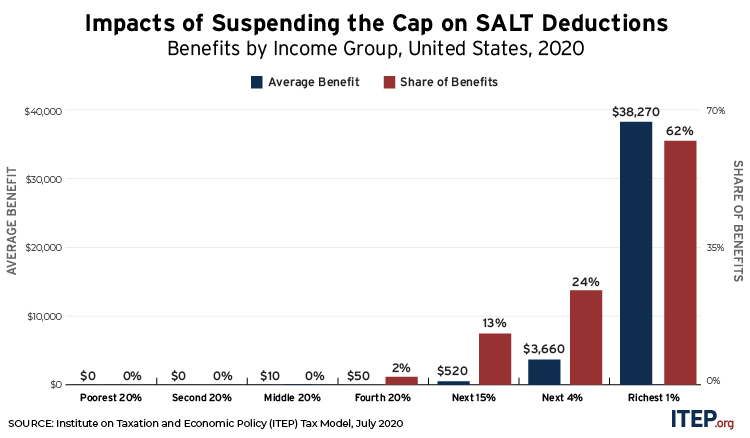

Salt Cap Repeal Has No Place In Covid 19 Legislation National And State By State Data Itep

How Raising The Salt Deduction Limit To 80 000 May Affect Your Taxes

Black Hispanic Families Would Benefit Less From Salt Cap Repeal

Supreme Court Won T Hear Challenge To Salt Tax Deduction The Hill

Analysis For Mass High Earners Tax Law S Cuts Will More Than Make Up For New Salt Cap Wbur News

Salt Deduction Cap Repeal Gottheimer And Suozzi Discuss Tax Cuts

Repealing Salt Caps Would Cost Another 500 Billion Committee For A Responsible Federal Budget

Calls To End Salt Deduction Cap Threaten Passage Of Biden S Tax Plan

Lawmakers Launch Bipartisan Salt Caucus Escalating Push To Remove Cap On Federal Deductions For U S State And Local Taxes Marketwatch

Repealing Salt Cap Would Be Regressive And Proposed Offset Would Use Up Needed Progressive Revenues Center On Budget And Policy Priorities

/cdn.vox-cdn.com/uploads/chorus_asset/file/22991459/1236366936.jpg)

What Proposed Salt Changes Could Mean For Your Next Tax Bill Vox

Bill To Remove Cap On Salt Deduction Passes In House Zeldin Votes No 27 East